Will Market Turmoil Continue?

Market Update 02/03/25

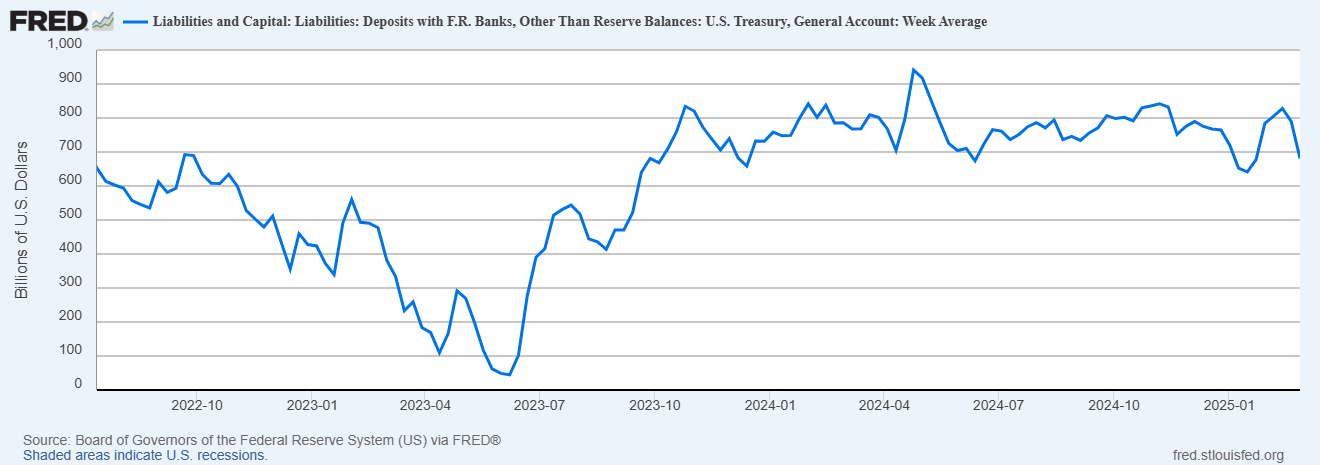

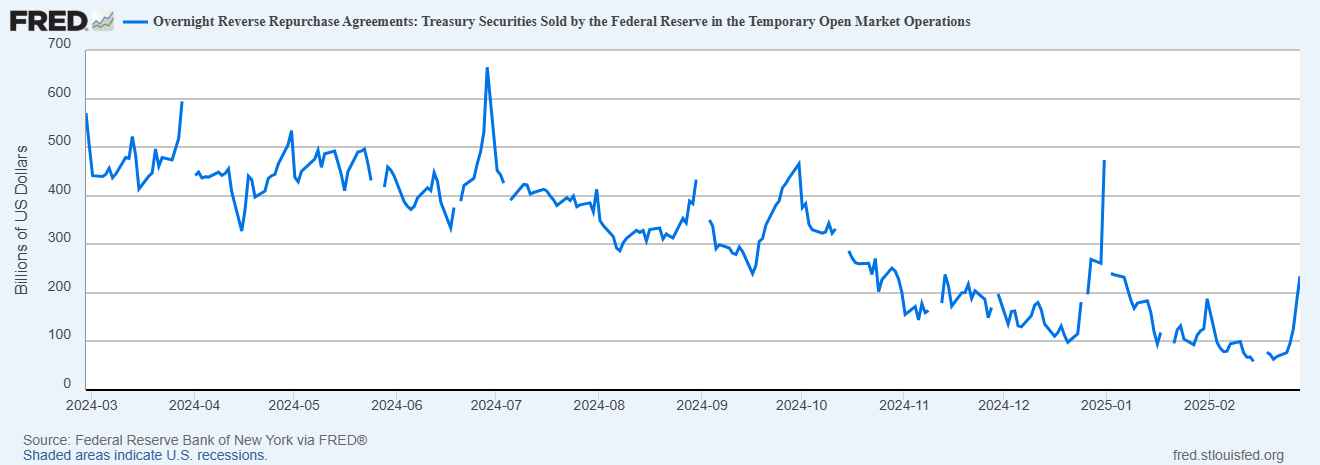

Last week, markets took an unprecedented turn for the worst as stocks dropped around 5% whilst Bitcoin slumped to lows last seen in November 2024, a -18% drop. We have previously contested in the Telegram Channel that there are still remaining liquidity injection outlets that granted, remain sparce but are able to accomodate markets for at least until April. We are of course talking about the flush TGA, that had been sitting around $800bn, and the RRP Facility which had just over $100bn in capital parked at the Fed.

We mentioned how with the RRP, once below a certain threshold, the reduction in assets will begin to directly shrink bank reserves which would equate to real tightening of policy. In regards to the TGA, this depletion would be heavily tied to the debt ceiling dynamics which are now taking place. Any spending would come from here up until terms are agreed.

We also attributed Bessent’s recent comments about continuing Yellen’s short term bill financing of the defecit as a positive for markets resulting in a lower 10Y, something the Trump administration has explicitly said it desires. Overall the picture does not look half bad, so why have markets sold off so aggresively?

Global Liquidity Continues To Expand

To begin with, the positives. Global Liquidity is currently on pace to expand higher in 2025. We noted in the Telegram Channel that GL has a lag of around 13 weeks before impacting markets. This leaves around 1Q advancement before we start to feel the upthrust of liquidity that has occured from late January up to now.

Througout Q4, we had shrinking Global Liquidity by around -$2.9T in nominal terms. This data includes Central Bank balance sheets and various other liquidity facilities in house. Since the dip in Global Liquidity, it has since picked up by around +$2.1T up to Week 8 2025.

We attribute the recent sell off to the huge withdrawl of liquidity in Q4. We anticipate a continuation of exphansive GL up until at least Q3. This does NOT mean that markets will continue to rise at the same pace because liquidity is used to accomodate debt, and as we approach the middle of the year, the large maturity wall will start to become a greater burden on global liquidity and assets will be one of the first outliers where particpants withdraw to cover debt repayments.

TGA Has Begun To Drain

The Treasury General Account has begun to drain since the middle of February. There has since been an injection of cash into the economy of around $170bn in 3 days. This is the most since COVID as debt ceiling measures ramp up.

Make no mistake, this big drawndown is a liquidity injection, similar to QE, but temporary. When we consider the net effect of this drawdown on liquidity, the outcome is scarce though.

Since the middle of February, a total of $305bn has left the TGA as cash moves from the Fed into markets. When we look at the net difference in regards to Fed liquidity, there is only a $27bn increase. This is extremely low.

We can associate this to the RRP usage which has recently increased resulting in a liquidity drain on markets as cash is parked back with the Fed. The RRP rose from below $100bn to $234bn in a couple days. You can see these two factors act as two way pully systems. This has dampened any positive liquidity effects we would expect from the TGA drawdown.

However, we do not expect this upthrust in the RRP to continue. This is likely an end of month close of accounts for financial instiutions to cover regulatory requirements. We expect this to move back lower which can then help us in calculating the real net effect the TGA can have on markets. For now this is a temporary setback.

QE Keeps Being Pushed Back

But SLR Exemptions Can Be Our “Stealth QE”

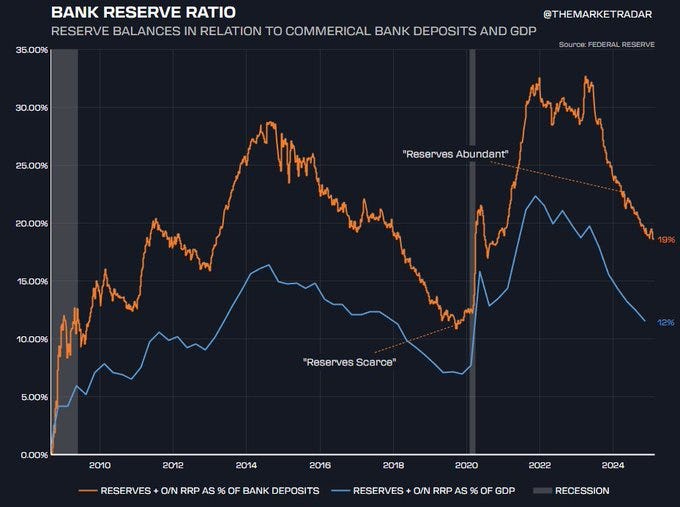

We have mentioned numerous times that the Fed needs to do alot more in regards to its balance sheet. This means not just stopping QT, but moving towards a form of “stealth” QE that keeps bank reserves plentiful and supported.

A Fed that decides to outright QE, would granted, be one that is responding to a shock in the economy or anticipating a recession. We can attribute this stance to Powell’s recent comments when testifying in front of Congress on Febuary 11th where he stated:

“Returning to the effective lower bound is not the base case anymore”

“We will continue to slow and then stop the decline when bank reserves are ample. Recent data and feel of market is that the reserves are abundant. We’re not yet stopping.”

“We do QE only when we’re at the lower bound and can’t cut interest rates anymore. Only in a situation when rates are at 0 and we’re a long way from 0 now.”

Based on the recent comments above, it is unlikely we will experience another form of QE as we did during COVID unless we see a huge stock market crash, bond market debactle like the UK in 2022 with Lizz Truss, a war, pandemic or other black swan.

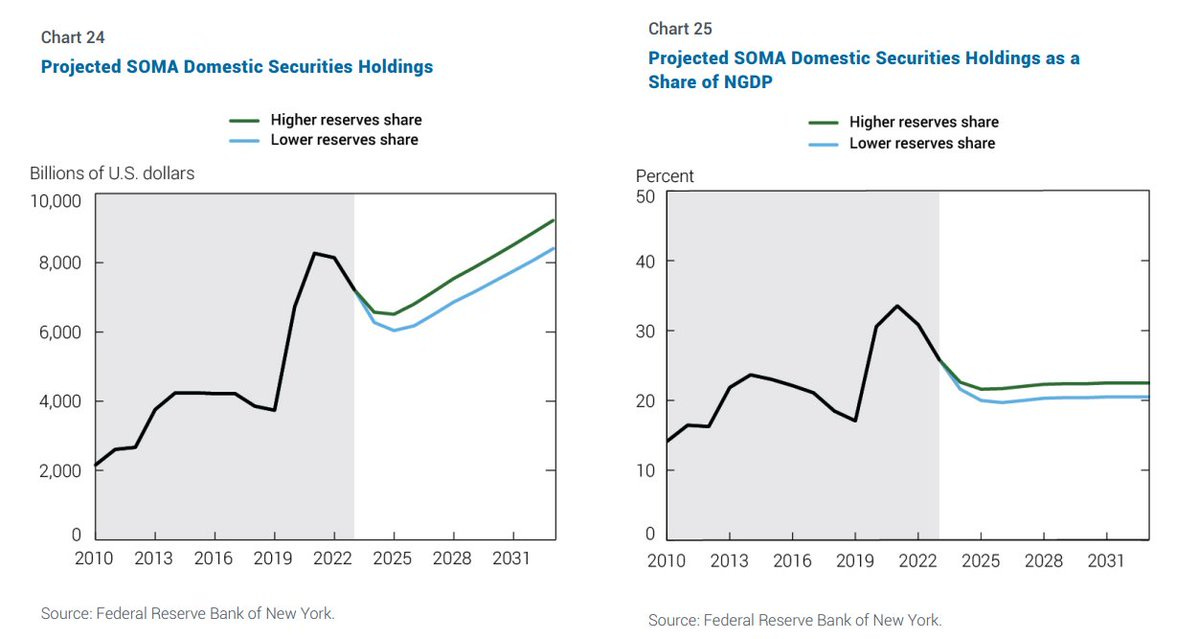

The Fed will instead, likely adopt an approach in which the balance sheet grows slowly alongside the pace of GDP, effectively keeping reserves as a percentage of GDP "flat". Below are SOMA projections for reserves.

Furthermore, we also received extra insight at the most recent FOMC meeting minutes which provided a big signal to how other FOMC participants have viewed the Fed’s balance sheet path.

"Regarding the potential for significant swings in reserves over coming months related to debt ceiling dynamics, various participants noted that it may be appropriate to consider pausing or slowing balance sheet runoff until the resolution of this event."

What we can gather from these comments is that the Fed is actively deciding on when to pause / stop QT. This is not exactly a direct liquidity impulse but is liquidity positive as it can gear markets to begin to “price in” the next stage of a possible balance sheet expansion (even if, as we have said, this is highly unlikely to happen).

Stopping QT will pause the continued downward pressure on Fed liquidity and bank reserves which Powell has previously said are “ample”, something we contested. The current drain of QT equates to $55bn per month, so stopping this would amplify the effects of a continued Reverse Repo and TGA drain… again, liquidity positive.

However, to be clear, more liquidity is needed. This is because of the amount of debt that is needed to be rolled over around the middle of the year and througout 2026. This is debt that was taken out during ZIRP. But there are still a few "liquidity setups" that can be pulled by policymakers before turning back to big QE. One of those levers is an adjustment to the Supplementary Leverage Ratio (SLR).

SLR (Statutory Liquidity Ratio) exemption allows banks to hold fewer government securities as part of their mandatory reserves, freeing up funds for lending and other activities. An SLR exemption would serve as a countermeasure to Powell's concern about Treasury market liquidity, which he made clear in front of Congress:

“I am somewhat concerned about Treasury market liquidity”

SLR exceptions would act as a form of “stealth QE” encouraging banks to hold more treasuries. This would increase government debt demand and support the bond market. Additionally it would allow for a more liquid Treasury market simply due to reducing price swings, lowering borrowing costs for the government and ensuring the system moves smoother.

Therefore, the likely sequence of events are something like this:

As RRP gets near 0 and we near the Fed’s target level of reserves of 12% - 15% of GDP, they will push to end QT. This does NOT mean they will start formal QE, but instead will likely result to an SLR exemption. This would dampen any liquidity pockets that may or may not become an issue as the debt ceiling resolves and the Treasury move to build up the TGA again. This build up could become an issue because the Treasury would be flooding the market with short term bills and money markets would need to buy those bills which sucks liquidity from markets.

For the current liquidity backdrop, it is marginally improving in that we will have the sequence of the TGA drawdown as well as QT ending into potentiall SLR exemption.

DOGE Layoffs May Come Through In Data…NFP Week

Since Trump took charge, he assigned Musk and the DOGE team to “clean up” government spending. One of the first motions that was put into place was the government layoffs. So far there have been over 250k layoffs of probationary workers. The primary focus of the cuts is on probationary workers (typically <1yr) which represent about ~10% of the gov workforce or ~250k workers.

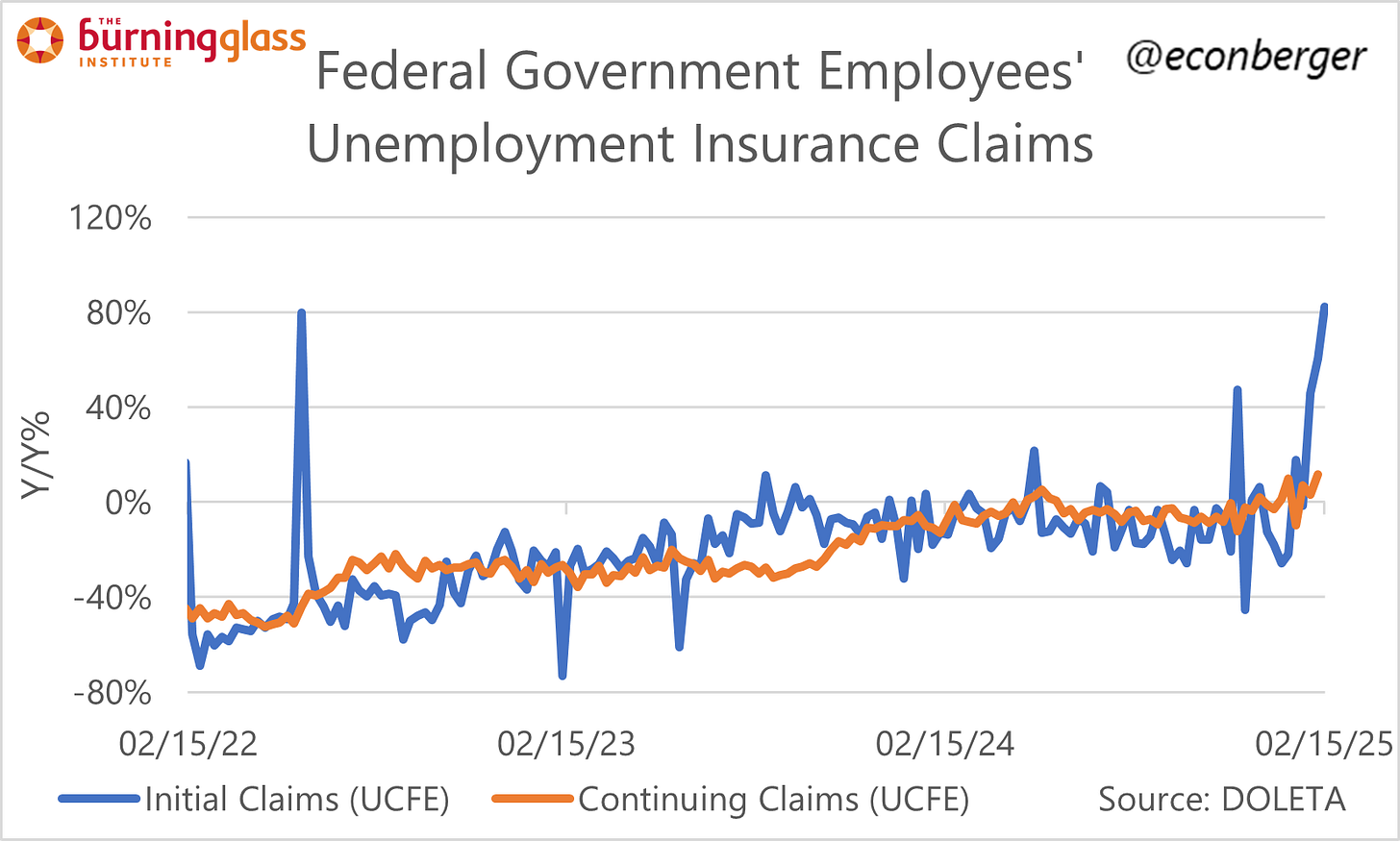

Given the timing of the cuts, we are very likely to see the first signs of these cuts in the March payrolls numbers. And the impact likely in the initial claims data sooner.

The next NFP print on Friday will be the first since the cuts took place. Alongside this, the private sector has been undergoing a wave of workforce cuts too.

Bessent Has UNDESIRABLE TARGETS MARKET PRICING IN

A big reason we believe for market sell off, is the rhetoric coming from the administration on cuts to the fiscal deficit. Bessent and Trump alike have been consistently bringing the hammer to market sentiment. We have consistently regarded comments on policy or the desired outcome of Fed officials and or Treasury officals to be absolutely vital in market perception and asset market prices. Bessent recently came out and said:

“WE NEED 3% FISCAL DEFICIT TO GDP”

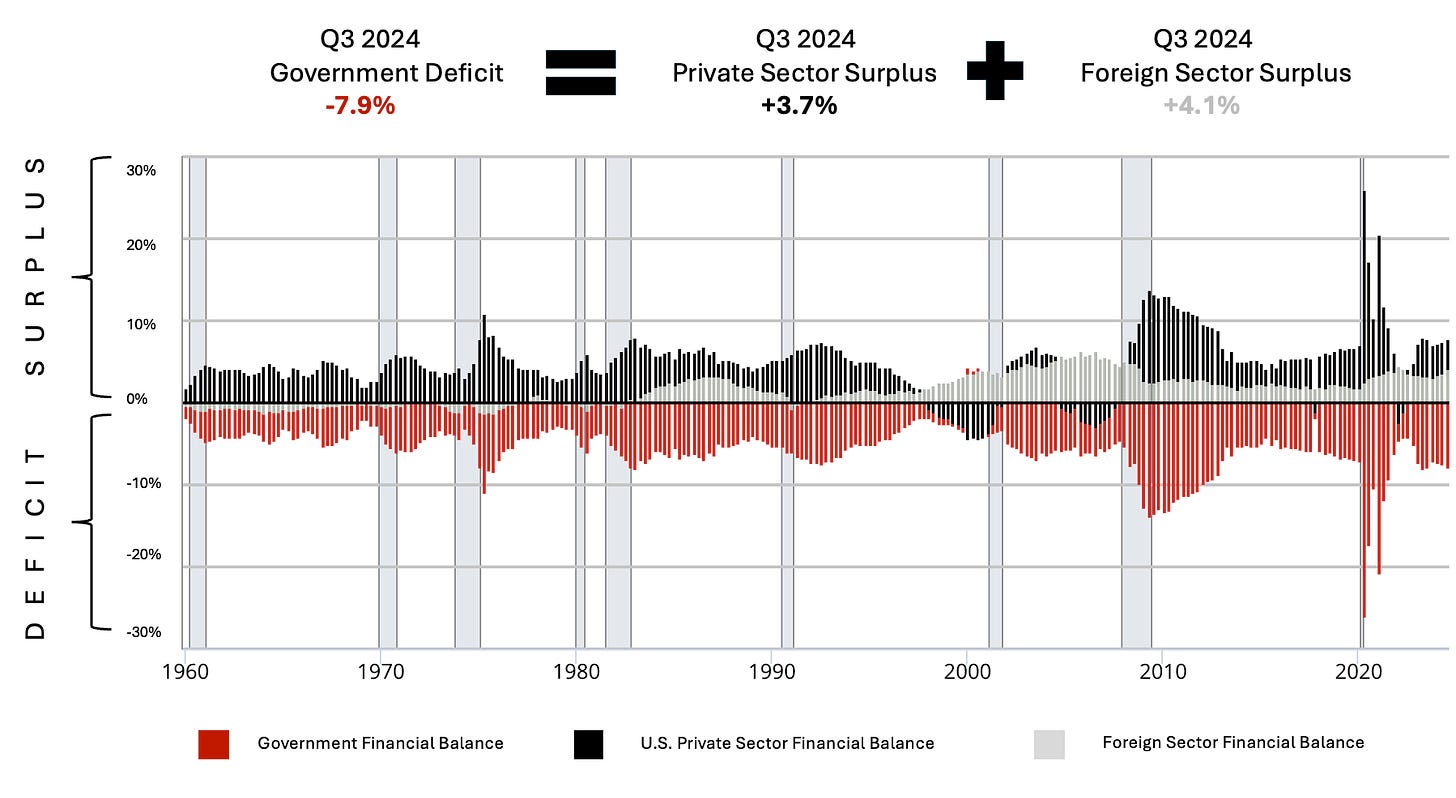

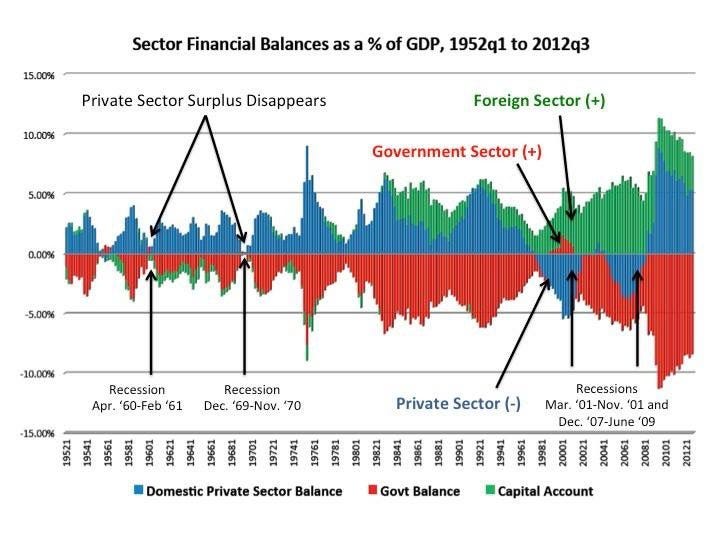

To get from a 7% deficit to 3% before next year, would require immense damage short term to assets and your standard of living.

To reach Bessent's 3% target on the government deficit by 2026. Assuming that Trump’s tariffs are what “help” shrink the US current account deficit to 3% of GDP. In that scenario, the financial surplus in the U.S. private sector would completely vanish.

Everyone should know that the market is in the era of fiscal dominance and there is no way to achieve a “balanced budget”. Furthermore, every budget balance attempt has ended in a recession. To balance the budget you must extract dollars from the economy and the only way to offset this is through a trade surplus. The US is NEVER going to achieve this (our next article will explain why), but hypothetically, even if this was possible, manufacturing in the US would never be able to be set up in time to end up exporting more than what is imported.

Conclusion

To conclude, we are in a situationally sticky phase of the market. Whilst Global Liquidity is expanding at a consistent pace, QT pausing is being hinted at and SLR exemptions are back on the table, all does not seem too bad. Meanwhile, when you consider the stance of the Fed, which has since January been largely hawkish, as well as rhetoric from Bessent and Trump, it seems to counter the underlying macro backdrop. In essence, market sentiment induces short term volatility, and this is what we are seeing currently. It is extremely wise, as we made clear in our Q1 report, that investors shed profitable holdings especially before April.